Many of our clients frequently ask about the possibility of donating money while simultaneously receiving tax relief. This is especially relevant for entrepreneurs who distribute dividends and pay corporate income tax (UIN) and want to understand whether donations are beneficial for a small company as well.

In our view – yes! The state offers you the opportunity to use part of your tax payments by directing them to donations. In practice, the difference is only about 1.5%, but in return you gain the opportunity to support a truly meaningful and noble cause at the local level – in your city, village, or community, whose development matters to you.

UIN: Pay the full amount or donate part of it?

Donations allow a company to reduce corporate income tax (UIN) when distributing dividends. In practice, this often means only a small additional cost compared to paying the full amount of UIN. In Latvia, every company has the opportunity to direct part of its corporate income tax to socially significant causes instead of simply paying it into the state budget.

Who can a company donate to?

A company has the right to donate to any organization; however, it is entitled to receive UIN tax relief only if the donation is made to an organization that has obtained Public Benefit Organization (SLO) status.

UIN tax relief applies only if the donation is made to:

a public benefit organization,

a state or municipal institution,

or another recipient specified by law.

Important: Not all donations qualify for tax relief, even if the purpose is noble.

Making Donations Without Risk: SLO Status

If a company wishes to apply the corporate income tax (UIN) donation relief, the recipient of the donation must generally have Public Benefit Organization (SLO) status. Without SLO status, a donation is permitted, but it does not provide any UIN tax relief. This status can be officially verified in the SLO register maintained by the State Revenue Service.

SLO status is required if the company donates to:

an association,

a foundation,

a religious organization.

Tax Relief for Companies in Relation to Donations

Latvian legislation provides several tax relief options for companies that make donations and distribute dividends (which are usually taxed at 25% of the dividend amount).

However, the tax amount can be reduced by paying part of it as a donation.

The UIN amount can be reduced by:

85% of the donated amount,

but not more than 30% of the calculated UIN on dividends.

This means that the relief has two “caps,” and both must be observed simultaneously.

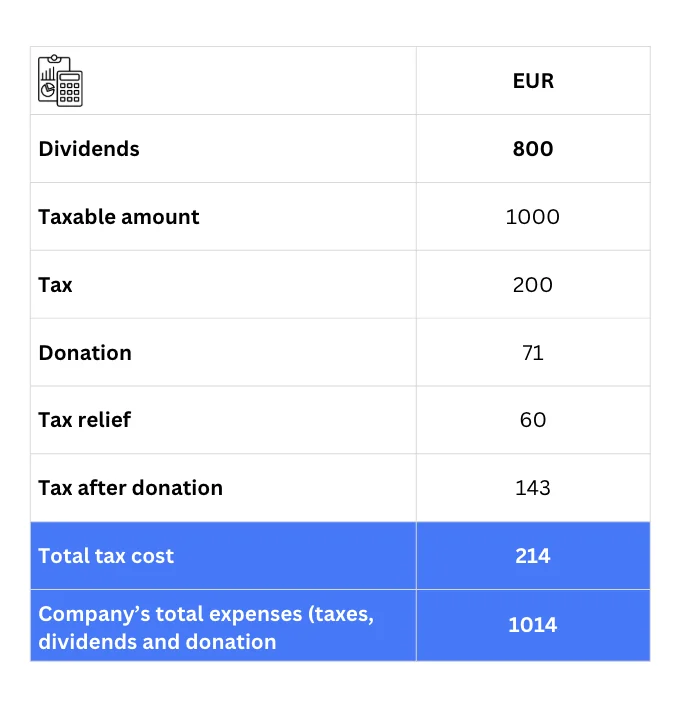

Here Is a Practical Example

We have created an Excel calculation module where you can enter your own figures and immediately see the calculated amounts.

Key Conclusion for Companies

A donation can be a good step for reputation and corporate social responsibility; however, it is not always financially advantageous purely from a tax optimization perspective. Therefore, it is not advisable to donate more than 35% of the corporate income tax (UIN) on dividends. Before making a donation, it is important to evaluate which of the three available UIN relief options is the most suitable in your specific situation.

This is particularly important for companies that either plan or do not plan to distribute dividends, as the tax impact may differ in each case.

Before making donations, we always recommend consulting your accountant and verifying the recipient organization’s Public Benefit (SLO) status.

Innovatio Capital provides tax advisory services! Contact our specialists.